interestingengineering.com

Here’s how Russia is using energy supplies as a weapon in war

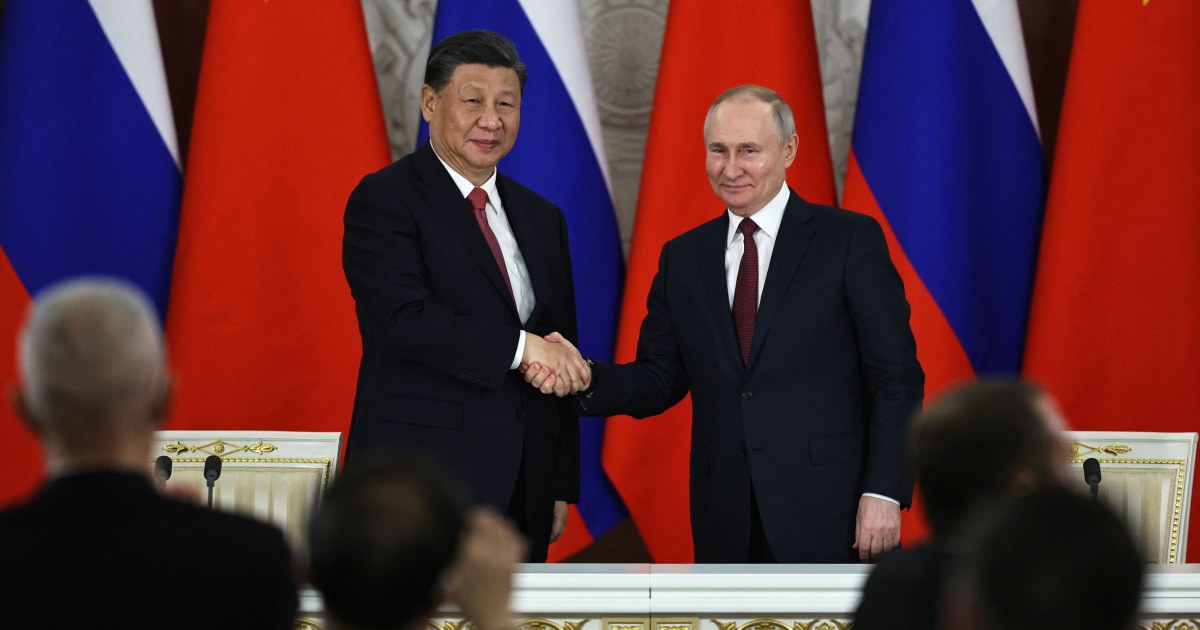

Putin recently announced that "unfriendly" countries importing oil and gas from Russia would now have to make their payments in Russian roubles.

Science & Tech

President Vladimir Putin recently announced that "unfriendly" countries importing oil and gas from Russia would now have to make their payments in Russian roubles, Reuters reported. This raises an important question of whether Russia is using its energy reserves as a weapon in the war.

The invasion of Ukraine, which Russia calls a 'special military operation,' began exactly a month ago. The U.S.-led Western allies immediately imposed economic sanctions on Russia such as denying it access to the SWIFT mode of international payments. Although Russia hasn't backed off from its aggressive position, its recent insistence on payments in local currency clearly indicates that the country is feeling the pain of the sanctions.

Russia's dominance in energy supply to the EU

Russia accounts for 40 percent of the gas supplied to Europe. In the three months of this year alone, the Russian supply of gas to Europe has varied between 200 million to 800 million euros ($880 million) a day.

Russia's stranglehold on European supplies is evident in the fact that even after openly condemning Russia for its aggressive stance, the European Union hasn't actually stopped energy imports from Russia. It has announced its plans to cut its dependency by two-thirds this year and end its alliance with Russia before 2030, however, these measures do not put any pressure on Russia now.

Russian gas not only heats homes in the European cold but also powers European factories. Even as the region's energy demand dips as the weather turns warmer, the power generation is still largely gas-based and this is where Russia is hoping to hurt the "unfriendly" countries.

Earlier this month, Russia released a list of countries that includes the U.S, EU member states, Britain, Japan, Canada, Norway, Singapore, South Korea, Switzerland, and Ukraine that have imposed sanctions in the wake of the Ukrainian invasion and demanded that deals with these countries be approved by a government commission.

The recent demand to accept payments only in Russian roubles is to be brought into effect within a week, even though existing contracts use U.S. dollars or Euro as the medium of exchange. While President Putin has promised that supplies will continue as earlier, they could be curtailed if payments are not made in roubles.

Russia also supplies gas to China and recently announced plans to build a major pipeline through Mongolia. This is likely to take a few years to materialize after which Russia could divert its supplies to China in a bid to keep its economy running but starve Europe of gas.

Impact of Russian move on oil prices

Although Russia holds sway in gas supplies, it is not the major contributor of oil to the global energy markets. The Russian invasion has already spiked crude oil prices with experts suggesting that $200 a barrel is also a possibility in the wake of the conflict.

If the Russian move on gas succeeds, it might even consider a similar payment mechanism for its oil supplies. While this is likely to push the demand for rouble up, it will also bring more volatility in oil prices.

As the largest producer of oil, consumers in the U.S. are unlikely to feel the pinch in supply but might feel the pain of rising prices.

In the wake of multiple economic sanctions, Russia is keen to leverage its position of strength in the energy supply business as a weapon. Whether this brings people to the negotiating table or flares tempers further, is something that will unravel in days to come.