This post may refer to COVID-19

To access official information about the coronavirus, access CDC - Centers for Disease Control and Prevention.

therealdeal.com

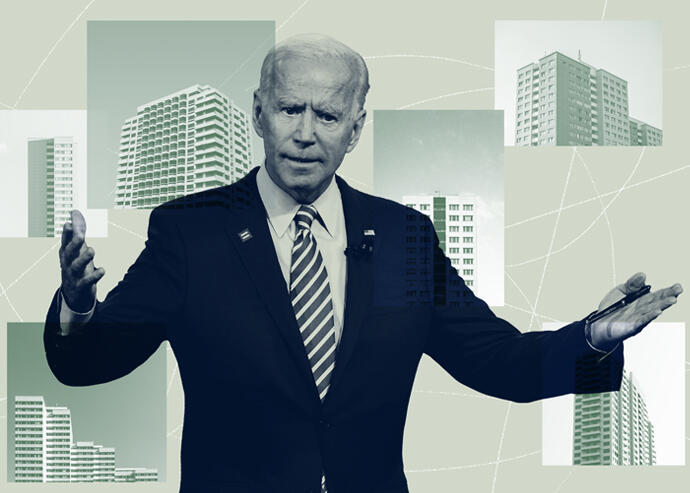

Biden Proposal to Eliminate 1031 Exchange Spurs Investment

Since last year, investors have reacted to potential changes in 1031 exchange program

Business

Last spring, Newmark broker Ken Zakin was hustling to find a buyer for a client’s retail property in Queens. The tenants had stopped paying rent because of the pandemic, leading to a major loss in income for the landlords, a family that owned the building for four decades.

Zakin planned to take advantage of the 1031 exchange program, which allows real estate investors to swap one investment property for another while deferring capital gains taxes. He’d sell the retail complex, then use the proceeds to buy a more stable income-generating property for the family.

Then came then-presidential candidate Joe Biden’s campaign proposal to eliminate the popular tax deferral tactic, also known as like-kind exchanges, as part of a broader plan to finance child and elder care. Though it was merely an idea at the time, Zakin said it started a countdown clock — he needed to get the deal done on the off chance that his client might lose the deferral benefit.

“We were definitely focused on closing it before the end of the year,” said Zakin.

Zakin’s client was one of many real estate investors who jumped through hoops to complete 1031 exchanges before the end of 2020, anticipating the program could be cut if Biden was elected president. And 100 days into his administration, the president has called for partially eliminating like-kind exchanges.

Now, investors and their advisors are stepping up efforts to preserve the tax break — and to mitigate the potential impacts that they’ve feared for months.

The 1031 conundrum

The proposed change to IRS Section 1031 — which would affect real estate investments where the profits exceed $500,000 — is part of Biden’s $1.8 trillion American Families Plan, which targets several longstanding tax loopholes to fund early education, direct payments to families with children and more.