www.credit-suisse.com

Why do investors need to engage in the companies they invest in? – Credit Suisse

As part owners, investors can hold companies accountable to sustainable practices. Learn how an engagement strategy and active ownership can benefit our world.

Business

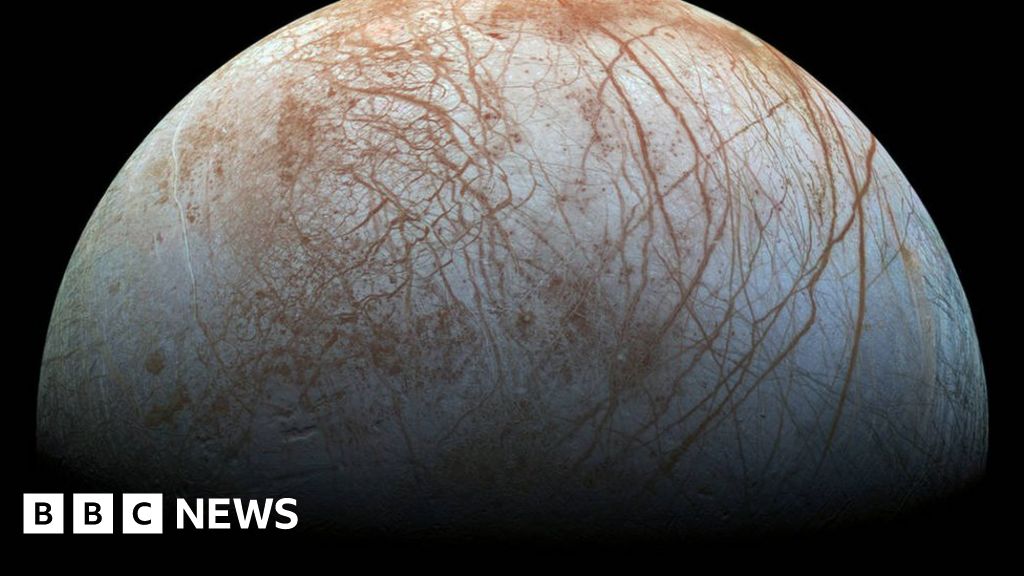

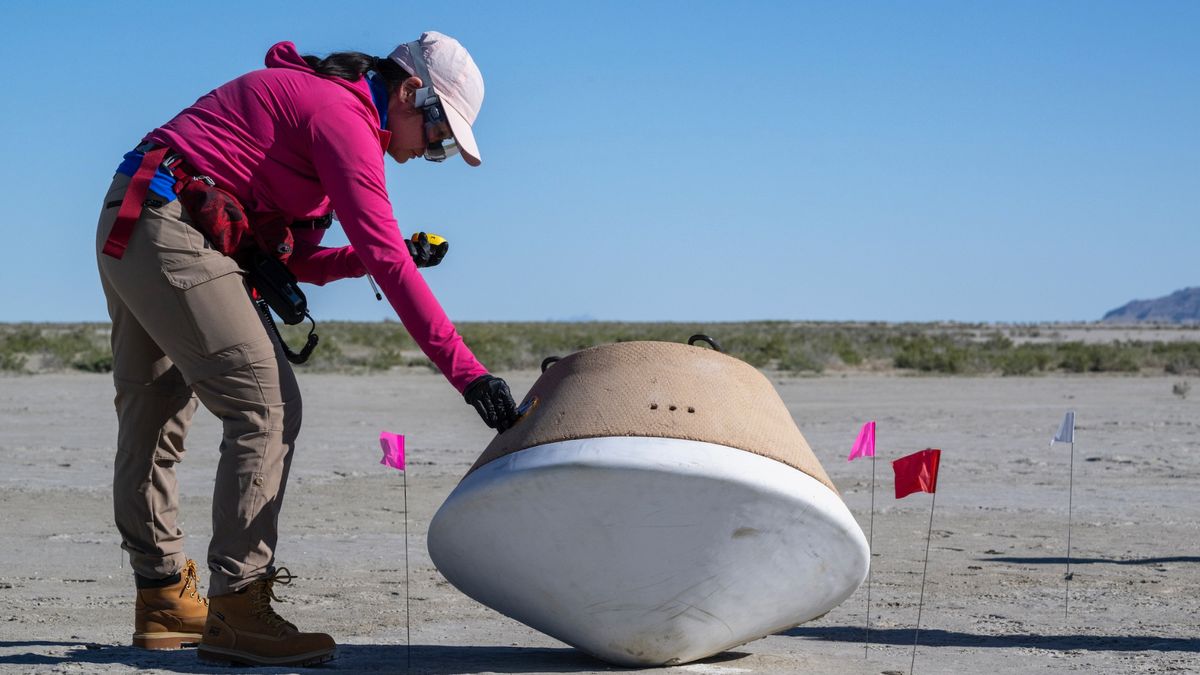

The economic value of global ocean assets is around USD 24 trillion, making it the seventh-largest economy in the world. A sustainable blue economy is not just crucial for planetary and human health – it also makes good business sense. Yet, with the acceleration of climate change, plastic pollution, and overfishing, the ocean's condition is deteriorating. Active investor engagement can help to turn this crisis around.

According to research carried out by Credit Suisse and Responsible Investor, over a third of large institutional investors see the sustainable Blue Economy as one of the most important sustainable investment topics in 2020, yet it remains one of the least invested themes across impact investors due to the lack of available solutions.

Increasing numbers of private and institutional investors are keen to support companies that are already good stewards of the ocean. There is also a growing trend of using the influential position of shareholders to impact positively the activities and behavior of companies by holding them accountable to ESG standards. This concept of "engagement" is one of the fastest growing responsible investment strategies across the globe. In the context of the blue economy, opportunities for investor engagement include climate change mitigation and adaptation; maritime renewable energy; plastic pollution prevention; and sustainable fisheries and aquaculture.

Shareholder engagement is driving change

In 2011, a group of 20 investors (all signatories to the UN Principles for Responsible Investment) engaged with 40 global companies across the seafood value chain, asking about their sustainable sourcing practices. In 2016, investors in UK supermarket chain Tesco urged the retailer to sell only fish and seafood certified as sustainable by the Marine Stewardship Council. Tesco, the UK's biggest fish seller, now has a sourcing policy aiming for 100% of its seafood to come from certified sustainable sources and is involved in industry initiatives promoting transparency, such as the Ocean Disclosure Project.

Sustainable investing: shareholder engagement as an ESG strategy

Engagement is the most direct way to create an impact within listed equities. Influencing corporate behavior through a proactive engagement approach can produce a virtuous cycle, leading to positive social, environmental, and financial results, and reducing risks to both our oceans and business. Moreover, it can generate returns and mitigate risks for investors.

There are relatively few studies on the financial impact of shareholder engagement. However, they all demonstrate that successful engagement results in positive financial outcomes. For details visit Credit Suisse Research Institute's Global investment yearbook 2020.

Successful engagement results in positive financial outcomes

Monthly adjusted return relative to engagement